per capita tax meaning

I did not receive my per capita tax bill. Can I confirm the balance due for my tax bill.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_Purchasing_Power_Parity_PPP_May_2020-01-d820977667e14964ab1b3538e0af520c.jpg)

What Is Purchasing Power Parity Ppp

The following is a fictional example.

. Gross domestic productpopulation GDP per capita. Can you provide me with my invoice number so that I can make a payment online. GDP per capita is a measurement used to determine a countrys economic output about how many people live in the country.

Per capita income PCI or total income measures the average income earned per person in a given area city region country etc in a specified year. Used primarily in economics PCI utilizes average income to calculate and present the standard of living and quality of life for a population or. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction.

The formula for GDP is as follows. The PRCS is part of the Census Bureaus ACS customized for Puerto Rico. Census Bureau American Community Survey ACS and Puerto Rico Community Survey PRCS 5-Year Estimates.

The GDP of a country is calculated by dividing a countrys total domestic output by its population. Municipalities and school districts were given the. What is the Per Capita tax.

If you dont have a financial advisor yet. Per capita income is an economic concept used to describe the measurement of the amount of money that is earned per individual in a given geographic region or country. I lost my bill.

Usually per capita calculations are done for cities states or nations but there is no fixed rule about what region can be defined per capita. It is calculated by dividing the areas total income by its total population. It means to share and share alike according to the number of individuals.

Per capita income PCI or average income is the measurement of average income per person in a specific country city or region within a definitive time period. The meaning of PER CAPITA is per unit of population. How to use per capita in a sentence.

Per capita income is national income divided by population size. However if you do not have a trust or will beneficiary designations can be set on taxable accounts to direct how that money gets divvied up at death just like with retirement accounts. Per capita distributions from net casino profits made to certain children are subject to a special tax calculation commonly referred to as the kiddie tax.

For most areas adult is defined as 18 years of age or older. Both Surveys are updated every year. Income per capita is a measure of the amount of money earned per person in a certain area.

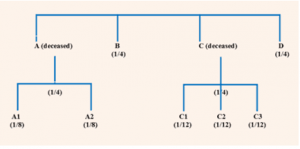

In a per capita distribution an equal share of an estate is given to each heir all of whom stand in equal degree of relationship from. A term used in the Descent and Distribution of the estate of one who dies without a will. What is Per Capita Income PCI.

This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. Per stirpes per capita and similar designations typically apply to retirement accounts and not taxable accounts because those fall under your trust or will. For taxable years prior to 2018 the tax is based on the parents rate if the parents rate is higher than the childs rate.

Per capita originates from the Latin language meaning by head or per. Pursuant to the Tax Cuts and Jobs Act of 2017 for taxable years 2018 through 2025 children. Per capita income is often used to measure a sectors average income and compare the wealth.

For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ. By or for each person. Per capita distributions could trigger generation-skipping tax for grandchildren or other descendants who inherit part of your estate.

Per capita income is the mean income computed for every man woman and child in a particular group including. Consider talking to a financial advisor about how to get started with estate planning and what per stirpes vs. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction.

Per capita distributions might mean for your heirs. It can be used to evaluate the quality of life and standard of living of the population or in determining the mean per-person income for a region. Income per capita is an important economic criterion in everything from domestic.

It can apply to the average per-person income for a city region or country and is used as a means of. Can I have a copy sent to me. The definition of income per capita is simply the average amount of money earned by people living in a specific area.

My billaccount information is incorrect. Latin By the heads or polls.

Information About Per Capita Taxes York Adams Tax Bureau

Who Pays And Who Receives In Confederation Finances Of The Nation

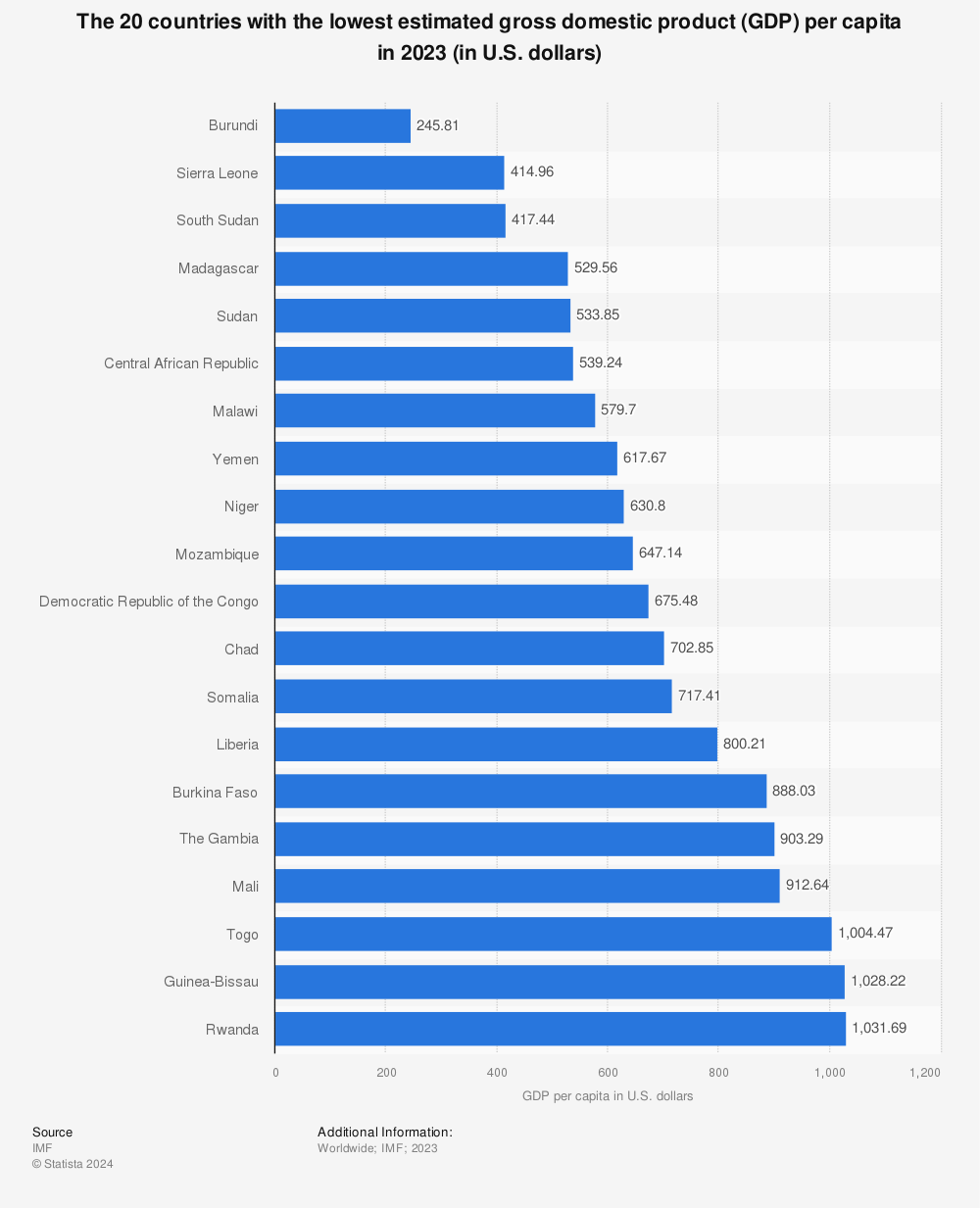

The 20 Countries With The Lowest Gross Domestic Product Per Capita In 2021 Statista

Income Per Capita Economy Provincial Rankings How Canada Performs

Who Pays And Who Receives In Confederation Finances Of The Nation

Income Per Capita Economy Provincial Rankings How Canada Performs

Per Stirpes Vs Per Capita Death Benefit Policygenius

Property Tax Definition Property Taxes Explained Taxedu

Tax Structure Tax Base Tax Rate Proportional Regressive And Progressive Taxation

Income Per Capita Economy Provincial Rankings How Canada Performs

Per Stirpes By Representation Per Capita What Do They Mean Russo Law Group

U S Per Capita Consumption Of Soft Drinks 2018 Statista

State Local Property Tax Collections Per Capita Tax Foundation

Carbon Taxes Worldwide By Country 2022 Statista

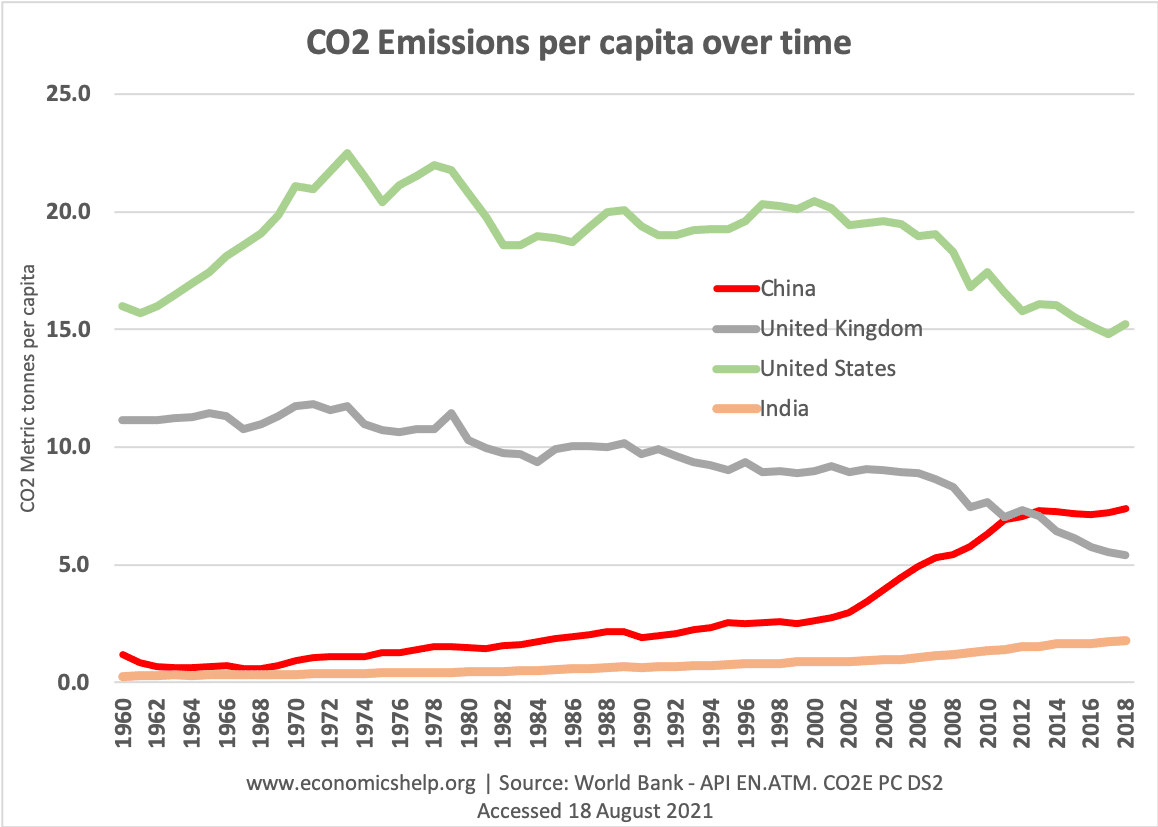

Top Co2 Polluters And Highest Per Capita Economics Help

Per Capita Definition Formula Examples And Limitations Boycewire

/GettyImages-545863985-e964b845dce944dfb2b94153aab83a7a.jpg)